This blog is part of the blog series “How to start your personal finances from 0”

1- The basics

3- Select your first credit card

If you want to learn more about our learning paths, go here.

Credit Cards 101

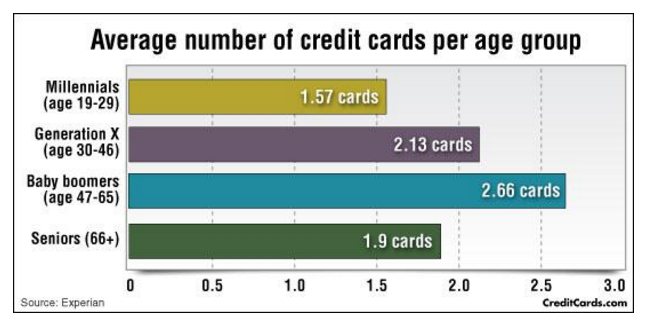

Did you know that there are over 1 billion credit cards in the US? That’s almost 3 cards for every man, woman and child! It’s probably safe to say that there is a little bit of plastic now in every wallet. Credit cards have become an integral and inseparable part of our lives and have actually changed our habits.

Despite being so ubiquitous, there are many things about credit cards which remain opaque to many consumers. Many of us have also undoubtedly wasted some of our hard earned cash trying to bring down our credit card balance after some large, lavish purchase! Used properly, your credit card can give you tons of benefits, but if you misuse it, it can cause significant financial pain for months.

How does a credit card really work and should you get one?

A credit card is not really a substitute for money, like many people think. It is actually a substitute for a consumer loan instead. There are some differences, of course. For example, a credit card offers an interest free grace period but to compensate, charges a much higher interest rate after the grace period. Therefore, it is best to think of a credit card as a sort of accessory for shopping that offers some benefits like an interest free period, convenience of not having to carry cash, being able to pay online and globally and so on.

Credit cards are almost indispensable for people in our day and age. You should feel free to use one or even two and enjoy the benefits but keep only one thing in mind:If you are paying interest on your credit card debt, you are not using it right!

However, if you intend to pay off your entire credit card balance every month, then you really need not worry about the interest rate too much. You should instead focus on any annual charges that the card company charges or how good their rewards program is.

What to do if you are refused a credit card?

An unfortunate truth is that having no credit history can sometimes be just as painful as having a slightly bad credit history. This is why students and young adults in the workforce have difficulties getting a credit card or even other smaller loans. Banks always check your credit score and if there is none (which would be the case if you have never borrowed before), they might not issue you a card at all. There might be other reasons for being denied a card as well - like if you change jobs too often or have too much existing debt. In such situations, there are other options available to you.

Alternates to credit cards

Missing credit card payments can not only cost you money, but it can even ruin your credit score. For example, it is not uncommon for people to miss small payments by mistake and later realize that a small 10 dollar missed payment has ballooned to hundreds of dollars and has brought down your credit score significantly! Even if you don’t use your card often, it is a good practice to check your account once in awhile. Maybe the bank put in a small 2 or 3 dollar charge for something which is now becoming overdue!

Other alternatives exist to credit cards. Debit cards offer almost all the benefits except for the fact that instead of taking a loan you utilize the money already in your account. This is ideal for people who have issues with controlling their spending! There are also prepaid cards and virtual cards available which you can avail online and use for your online shopping needs. Finally, mobile payment technologies like Apple Pay, Google Pay, Android Pay, Paypal etc. seem to be well positioned to take a substantial chunk of the online and retail payments market share.

How to protect yourself from fraud or identity theft

As per FBI data, bank robberies are down by almost 50% between 2004 and 2014! Unfortunately, however, this only means that financial crime has moved into the cyber domain. Identity theft and credit card fraud is on the rise, not just in the US but in countries around the world. Here are some tips to protect your credit card information (both online and offline):

- Never share information like date of birth, social security number, bank account number etc unless you have a very good reason to.

- Never share your PIN or CVV number with anyone for any reason whatsoever.

- When shopping online, always opt for trusted sites like Amazon or eBay.

- Website starting with https:// rather just http:// are more secure (if you don’t have an https:// prefix where you are shopping, you should probably not go ahead with your purchase).

- Keep your contact details with the bank up to date (so that you can quickly get any notifications or calls regarding any transactions or suspicious activity).

- Try to avoid using public computers and unsecured networks. For your own network and devices, use strong passwords.

- Save the customer care number of your credit card company on your phone so that if you lose your card, you can call them RIGHT AWAY and have it blocked immediately. Even if you are not 100% sure that you have lost it, it is always a good idea to get your card blocked. You can always get it unblocked later.

- Keep checking your account statements or the online portal for any suspicious transactions, even ones for smaller amounts. If there is a transaction you can’t identify, try to get to the bottom of it!

The costs and fees explained

The interest rates on credit cards are usually Annual Percentage Rates or APRs for short. The difference between APRs and normal interest rates is that APRs also includes other fees that a card company might be charging. So it is generally a better representation of the total cost of a credit card.

You might be wondering why credit card interest rates are so high? The basic problem is with the underlying concept itself. Credit cards offer a free grace period for the first few weeks after you have used it. If you keep paying off whatever you use every month, then you can basically go an entire year without having to pay a single cent! As you can imagine, credit card companies would NOT be making any money off of such disciplined customers. Therefore, to compensate for their loss, they charge extra when people do delay a payment. This is why credit cards can be both a great little reward for people who can afford to use them wisely and a curse for those who are tempted to go over their safe limits.

Coming back to the various types of interest rates, your card company might specify different rates for different things. For example your normal purchases would have one rate specified, withdrawing any cash might have another (usually higher) rate, delayed payments will attract a much higher penal rate in addition to penalty charges. Keep in mind also that the company has the right to change your interest as long as they give you a prior notice.

What to do if you have too much credit card debt?

Credit card debt is one of the costliest forms of borrowing which is still legal. For many people, credit card debt can act as quicksand, sucking them in ever deeper with ballooning payments. The interest rate charges on overdue credit card debt approach levels that might even be considered extortionate. In addition to a very high rate of interest, the card company will also likely charge you a fixed fee which can keep on increasing for each month that you delay a payment!

So how to avoid a credit debt trap? Here are some tips:

First things first - get your free credit report. You are eligible for a free credit report every year as detailed here. Use it to see how bad things are. The report will show you details of ALL your loans and credit cards including details of any delayed payments and how they are affecting your credit score. The first step to resolving a crisis is to know the full extent of the problem. Analyzing your credit report will help you to determine your options. If your score is good enough, you may still be able to get another loan and pay off your credit card. You need to do this quickly though as with each passing week that you are overdue, your score keeps deteriorating.

Personal Loan/ Loan from credit union/ Home Equity Loan - If you are eligible for a loan from your credit union or can get a personal loan processed quickly, you should exercise that option and use the proceeds to pay off your credit card debt. Such loans will almost always be cheaper than whatever you are paying to the credit card company. A home equity loan should also be considered if the above options do not work out.

Balance Transfer- You can switch to a new credit card company and ask them to pay off your old debt. This is good option if your current company is charging extremely high rates and you find a good alternate. Keep in mind however, that the new company will start charging you interest on the amount transferred immediately. Also, there might be a fee component involved and you need to make sure the savings are substantial enough to warrant a switch.

Debt consolidation companies - If your credit score is not good enough to get a loan, you might consider approaching some debt consolidation companies. These companies usually have tailor made solutions for people with high credit debts. Some good examples: www.curadebt.com, www.careonecredit.com, www. nationaldebtrelief.com etc. Just keep in mind- if an offer sounds too good to be true, it probably isn’t.

Failing all of this, you can still continue to pay as much as you can towards your credit card debt. It might take a bit longer, but eventually you’ll be debt free and much wiser than before!