In previous articles, we have discussed what insurance is and how it functions. We will now explore one of the most important types of insurance in the United States: health insurance.

Discussing health insurance without mentioning the current political debate would leave many stones unturned. For this reason, let’s briefly cover how healthcare has changed in the United States during the last decade and where things are headed. From this vantage point, you will be prepared to make better health insurance decision for you and your family in 2017.

Health Insurance in the United States – A Changing Landscape

Prior to 2010, having health insurance was voluntary in the United States. This meant that being uninsured, while risky, was a decision left up to every American.

The Patient Protection and Affordable Care Act (known as PPACA, ACA or Obamacare) changed everything. This landmark legislation, signed into law by President Barack Obama, built a nationwide healthcare system (or “marketplace”) and required every American to carry some type of health coverage. This law was built and designed to do three things:

- Expand access to health care

- Lower health care costs

- Protect patient rights when dealing with insurance companies

This law, in many respects, brought the United States on par with the rest of the developed world. Before this legislation, the United States was the only “developed nation”, as classified by the World Health Organization, which did not have some type of nationalized health care system in place. Norway, New Zealand, Germany, Canada, the Netherlands, Japan, Australia, South Korea and Hong Kong have all had similar systems in place for decades.

All things considered, the ACA has been successful at providing more coverage to Americans and protecting these policyholders from aggressive insurance company tactics. The cost of health care has been one item which the ACA has had trouble resolving.

What The Future Holds

Since being signed into law, the Republican party has been staunch critics of the ACA. During the 2016 election, President Elect Donald Trump pledged to repeal and replace the program. His reasoning is that individuals should not be required to purchase health care and that the costs to individuals and businesses are too high under the existing structure created by the ACA.

This will be a major topic of debate during 2017 and it is still very unclear what “Trump Care” will look like moving forward. The bottom line is that the ACA remains law in 2017 and it will take significant work from Trump, and the congress, to make any meaningful changes. Keep an eye on political developments related to health care in the coming months, but do not make any health care decisions based solely on rhetoric out of Washington.

What You Need to Know

With the political discussion out of the way, let’s explore the healthcare market within the United States and some basic vocabulary which every consumer should understand.

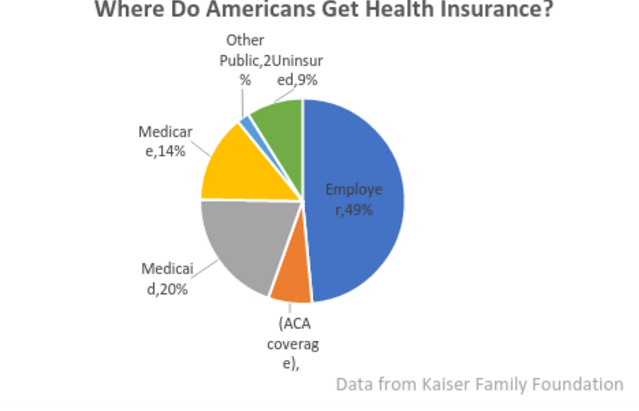

First, let’s look at where most Americans get their health coverage. It is important to understand that the new programs created under the ACA are just a small component of the overall health insurance industry in the United States.

Employer Programs

In 2016, half of all Americans were fortunate enough to receive health insurance through their job. This works by an employer paying all, or a portion, of the monthly costs from health plans. Even if your employer requires you pay a portion of health coverage costs, you have the added benefit of paying these costs in pre-tax dollars. This means, before any taxes have been taken out. When you purchase plans as an individual, you are paying for the costs in post-tax dollars.

Medicaid

Medicaid, established in 1965 by President Lyndon Johnson, is a federal program which provides health coverage to individuals with low income who could not otherwise afford coverage. Medicaid also manages the Children’s Health Insurance Program (CHIP) for children in low income families. Click here to learn more about Medicaid and CHIP, and to see if you qualify. Nearly 20% of Americans receive their health coverage through Medicaid.

Medicare

Medicare, also established in 1965, is a federal program which provides health coverage to Americans who are 65 or older, have certain disabilities or specific medical issues like kidney failure. There are several different levels of Medicare to explore which can provide coverage. Click here to learn more about the federally operated Medicare program and to see if you qualify. Roughly 14% of Americans receive coverage through Medicare.

Non-Group or ACA plans

Non-Group or ACA plans show the percentage of Americans which purchase health care as an individual, without the assistance of an employer. This could be by working directly with an insurance carrier or by using the ACA’s healthcare marketplace available here. This is the best option for individuals and families who do not receive healthcare through an employer and do not qualify for either Medicare or Medicaid.

Uninsured

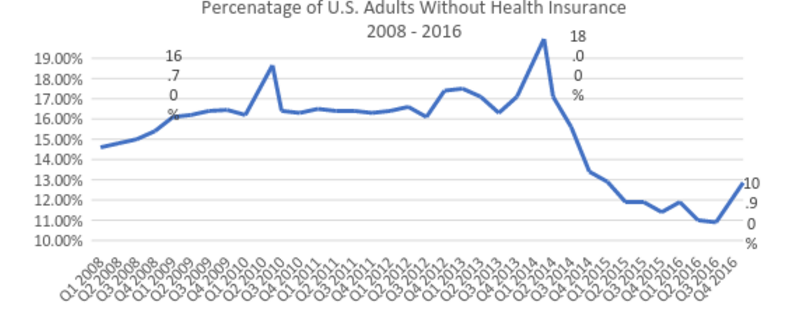

According to the Kaiser Family Foundation, the uninsured population is roughly 9% in the United States. The Gallup-Healthways Index puts this figure closer to 11%. It is safe to assume that roughly 10% of Americans are living uninsured in 2017, down significantly from 17% in 2008. Under the ACA, there are tax penalties for not having insurance for more than three months out of the year. In 2016 and 2017, these tax penalties are calculated as a percentage of income or an a per person bases - whichever is higher.

Percentage of Income 2.5% of household income, not to exceed the national average price of a Bronze plan sold through the insurance marketplace

Per Person $695 per adult and $347.50 per child, not to exceed $2,085 for the year

You may be exempt from paying this fee even if you don’t have health coverage. You can use this tool to determine if you, or your family, is exempt. What is the penalty for not paying this fee? There are no liens, levies or criminal penalties which will be charged but the IRS will remove the amount owed from future tax refunds.

Considering the cost of health care, going uninsured and paying the tax penalty should only be used as a last resort.

The United States currently has some of the most expensive health care in the world, and according to the Centers for Medicare and Medicaid services, health spending in the United States is projected to grow by 5.8% per year through 2025. Having health insurance can help protect you, and your family, from medical issues which are part of life.

Start Shopping

If you are interested in getting health coverage, where can you start? A good starting point is to understand the basic vocabulary that is part of the process. Below are terms which every consumer should understand.

Health Insurance – in exchange for a monthly payment to an insurance company, this company will pay all, or a portion, of medical bills during the year. Each health insurance plan varies, with different plans covering different types of care. A health plan is a contract, so to be certain you understand what IS and IS NOT covered under the plan before you sign. Read this article we published for more information on the basics of insurance and how the industry functions.

Insurance Carrier – An insurance carrier is a large company which sells health insurance. By understanding how frequently customers will need their insurance, the carrier can sell plans and make money in the process. Insurance carriers operate like any other business, and are for-profit companies.

The Healthcare Marketplace of Exchange – Just like a produce market, the healthcare marketplace brings together buyers and sellers. These marketplaces were established by the ACA and can be federally managed, state managed, or a combination of the two. States which use state managed exchanges are California, Colorado, Connecticut, Idaho, Maryland, Massachusetts, Minnesota, New York, Rhode Island, Vermont and Washington. Every other state either has a federally managed program or a partnership between the state and the federal government.

Premium – This is the amount you pay each month to an insurance carrier for coverage.

Claim – This is a request for payment to the insurance carrier.

Deductible – This is an amount you will pay for health care before the insurance carrier will cover any expenses. For a plan with a $1,000 annual deductible, you would pay the first $1,000 of medical expenses during the year before the insurance carrier would cover anything. Plans with high deductibles are generally built for individuals who expect to need little medical care during the year. High deductible plans are generally cheaper than comparable low deductible plans.

Co-Insurance – This is the percentage of medical expenses you pay after the annual deductible is met. Typically, health insurance plans come with 20% co-insurance, meaning that after the deductible is met you would be liable for 20% of all costs while the insurance carrier pays 80%. Just like high deductibles, plans which have higher co-insurance rates will be cheaper on a monthly basis. If you are young, healthy or just don’t expect to need much medical care during the year – consider a plan which has higher deductibles and co-insurance rates.

Max Out Of Pocket Expense – This is the maximum amount you will pay for health costs during a given year. For ACA plans through 2017, the maximum out of pocket expense is $7,150 for an individual and $14,300 for families. This is up from $6,850 for individuals and $13,700 for families in 2016.

Catastrophic Plan – This is the most basic form of health coverage which is compliant with ACA requirements. These plans provide little benefits on an annual basis and will have higher out-of-pocket expenses, deductibles and coinsurance rates. These plans are built to protect against a truly catastrophic event, and will provide little compensation for checkups or exams.

Enrollment Period – Health insurance is a little bit odd, in the sense that you cannot always get covered immediately. An enrollment period is the time period when insurance carriers are taking on new customers. For ACA plans, the enrollment period for 2017 runs from November 1, 2016 through January 31st, 2017. Outside of this window, you will be required to qualify for a special enrollment period. Businesses choose their own enrollment period, so check with your employer if you qualify for employer sponsored coverage.

This list is just a start, and there are many more terms which are important to know and understand as you navigate the health insurance world. For a complete glossary of terms, use this resource from HealthCare.gov.

The health insurance marketplace can sometimes feel like a daunting place. We will be here every step of the way to help ensure your next health care purchase is the right one.