Buying a home is a dream come true for most of us. It’s a huge commitment and in most cases, the biggest financial investment that we make in our lifetime. The home buying experience can be both exciting and daunting at the same time. Once you have researched the property, the neighborhood and the financing options you are left with just one more thing – insurance!

Home insurance is not only necessary for you to protect yourself from a loss, but is also mandatorily required by lenders who finance the mortgage. You even have to include the lender in the insurance policy itself and are required to keep the policy active for as long as the mortgage lasts.

What losses does the policy cover?

The most basic coverage is for the dwelling or the house itself and any attached fixtures like plumbing, wiring and permanently installed AC units. Usually, there is additional coverage for various things like:

- Other structures like fences, detached garages, sheds and so on

- Your personal property including clothes, electronics, furniture etc.

- Expenses for a hotel stay or something similar for the duration of the repairs in case your house is damaged

- Personal liability and medical coverage which covers you against legal and medical damages in case someone is hurt on your property or incurs some damage

This is best explained with the help of a few real life examples. Consider these situations:

- A tree branch on your property falls and damages your neighbor’s car.

- A guest at your house slips near the pool and breaks a tooth and needs to pay medical expenses.

- A lightning strike fries the Air Conditioning unit.

- Someone steals from your house while you are away.

- Your dog bites someone at your house and you are sued and asked to pay damages.

- A kitchen fire destroys some appliances.

In all of these instances and thousands more which occur every day in modern households across the country, you would need insurance to cover your risk and expenses. It might seem like some of these things are too trivial to bother about, but you never know when you are hit with a large expense or bill and it’s best to have the insurance in place which will cover you in your hour of need.

What events or perils are protected against?

It is not uncommon for policy holders to get a rude shock when they make a claim under their policies only to find out that whatever happened was not covered. For something as expensive as a house, it is imperative to be thorough and safeguard yourself from all possible risks.

Before we get into the details, there is one basic concept that you should keep in mind. Insurers will typically cover most perils unless your region is prone to something in particular. In that case, you would have to buy protection against that separately. It sounds counter intuitive but that’s how it works. For example, storm and hail damage may be covered in most states under the normal policy, but in states where storm damage is common, you might have to pay extra.

There are various standardized types of home insurance policies. The Basic Form cover a list of perils which is mentioned in the policy documents like fire, theft, civil unrest, hailstorms etc. However, the most common policy type is called the Special Form, which covers everything except a list of perils which is mentioned in the document. These exceptions are things like earthquakes, war, nuclear incidents and floods – which are generally not covered by insurance companies. This is because the massive claims from such disasters would cause the insurance companies to go bankrupt and render them unable to honor their claims. However, there are options to get some coverage against these as well. For instance The National Flood Insurance Program by the federal government or the earthquake protection policies offered by the state of California offer protection against specific natural disasters.

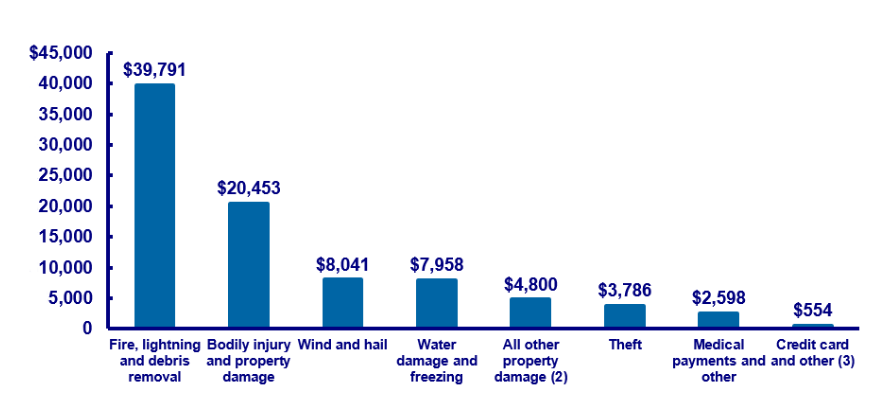

This figures shows the average claim amount for different perils. Source: Insurance Information Institute

Deductibles

The deductible in insurance parlance is the amount that you have to pay personally and upfront before the insurer has to pay anything against a claim. The idea is to discourage policy holders from filing trivial claims, but not be a hindrance when a real claim is to be made. This is why the deductible amount is kept low enough so that policy holders can still pay it and get the balance amount paid by the insurance company. Also, if you opt to go for a higher deductible amount, then the insurance company will likely lower your monthly premium a bit as a reward.

How is the premium calculated and how to get the best rates

The premium on a homeowner’s insurance depends on the actual cost of the home and the probability of something happening that would cause an insurance claim. Knowing what causes the premium to rise or fall puts you in a better negotiating position with the insurance company. Here are some of the things that might increase premiums:

- The cost of rebuilding the house- the higher the cost the more the premium

- The age of the house, older homes are more susceptible to damage and therefore attract a higher premium

- Material used in construction- wood houses are prone to fire and therefore costlier to insure

- Any potentially dangerous items or structures that can cause injury like swimming pools, outdoor equipment, treehouses etc.

- Dangerous pets like aggressive dogs or other large or dangerous animals

- The insurance claim history of your neighborhood. For example, if there are a lot of insurance claims due to burglaries in a neighborhood, the insurance premium for the entire area will likely rise.

- If your area is particularly prone to natural calamities like floods, storms, earthquakes etc.

You might not be able to control or compromise on some of these things, but there are other ways for you to cut down on your premium costs:

- If you have a good credit history, you will generally get a better deal not only for insurance but most other financial products as well. This is why it is a good idea to keep your credit history in top condition.

- An ongoing relationship with a single insurance company might allow you to get a better quote. You can even choose to move your other policies like auto, health etc to get a stacking discount on all policies. As time goes on and if you are able to maintain a decent claim record, your premium will generally decrease as well.

- Making attempts to protect your house with things like burglar alarms, smoke detectors, sprinklers,reinforced doors and so on. You can even add some protection against natural perils like hurricanes, storms etc and this will not only help protect you and your family but save you a bit on those monthly insurance premiums.

- Making too many claims can also lead to higher costs or even cancellations. Each claim will increase your premium and if your claim rate is much more than the general average for your neighborhood, you would likely be asked to pay more or even face cancellation.

- It is generally not a good idea to drop your insurance and get it again after a few months. Once you drop your insurance, it would be difficult to get your home insured again as the insurer would suspect that you dropped the policy because you couldn’t pay the premiums. Also, the insurance company might suspect that you are anticipating a claim and that is why renewing a policy that you cancelled before. All of these are bad credit signals and would likely increase your insurance costs rather than decrease them.

Being prepared and filing claims

An insurance policy reads like a legal document. Therefore, in case you have to make a claim, you need to ensure that you can prove all your claims.

- The first and most important requirement is to pay the premium on time. If you miss this, you would not be in a position to make a claim or contest a decision.

- The second most important thing it to make sure that you maintain your home in a reasonable manner and do not take any unnecessary risks. For example, if you have an old or leaky heating system, which is liable to break down and cause damage, you should have it replaced within a reasonable time frame.

- The third thing is to make sure you keep track of everything that is insured so that you can prove the extent of your losses. Ideally, you should keep the receipts in a safe place and even take photographs of expensive items in your home. Make sure these photos and receipts are backed up somewhere safely, like on an online storage system where they can’t be lost.

Before filing a claim, make sure to read the policy once again and gloss over any specifics which might be relevant to your current claim. It is generally advisable to prepare all the necessary documents beforehand so that your claim process goes smoothly.

Choosing the right insurance provider

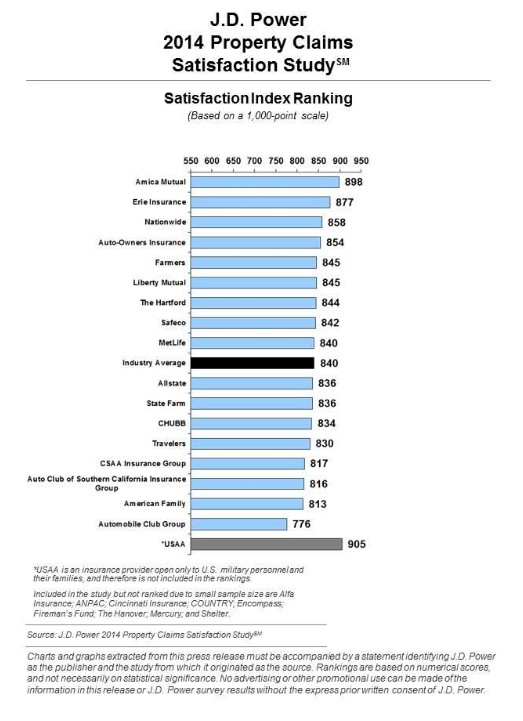

Selecting an insurance company can be as easy or as hard as you want it to be. It’s a matter of how thorough you want to be while making a choice and how much you expect to save. You might be tempted to go for a cheaper option, offered by a smaller company but the most important thing to consider is this: Will this company treat me fairly when I make a claim? After all, you buy insurance and pay the premium for years and all of it just for that one time (or maybe a bit more) when you make a claim. Therefore, you have to make sure the company will treat your claim fairly and honor its commitments when you file a claim. You can’t generally go wrong with choosing a large, nationwide insurance company. These companies have set processes and procedures and care enough about their reputations to not do something which is blatantly wrong. Some of the most popular insurance companies across the country are Amica, Erie Insurance (these first two also generally rank the highest in customer surveys), StateFarm, Allstate, Liberty Mutual, Country Financial, MetLife and Nationwide.

Generally speaking, most of the insurance claims go through successfully without any problems (as can be assessed from the above table showing consumer satisfaction levels). The more research you do beforehand, the better your chances of sailing smoothly. However, your experience with any insurance company will also depend on what kind of an adjuster (the person who investigates insurance claims) or representative you might run into. Some people have very good experiences while for many others it can be rather frustrating. Either way, the representative can’t deviate too much from the company’s formal policies and you should be aware of this. In order to get the best experience possible, always ensure that you make notes of any conversations (maybe even record them), along with dates and lists of documents submitted. It might not be a good idea to go overly aggressive right at the onset. Try to come off as calm and collected and research as much as possible about your policy so that you are not caught off guard. In case you still feel you are being treated unfairly, state your reasons and ask to speak to a supervisor.