This blog is part of the blog series “How to start your personal finances from 0”

1- The basics

3- Select your first credit card

Best Credit Cards for Latinos

If you are looking for a credit card today, you are not alone.

A credit card can be a great way to establish credit, simplify your monthly bills, and even earn airline miles. The truth of the matter is, however, that Latinos still use credit cards less than the average American.

In this article, we will explore the basics of credit cards and provide information on some of the best cards out there for Latino families.

Let’s get started.

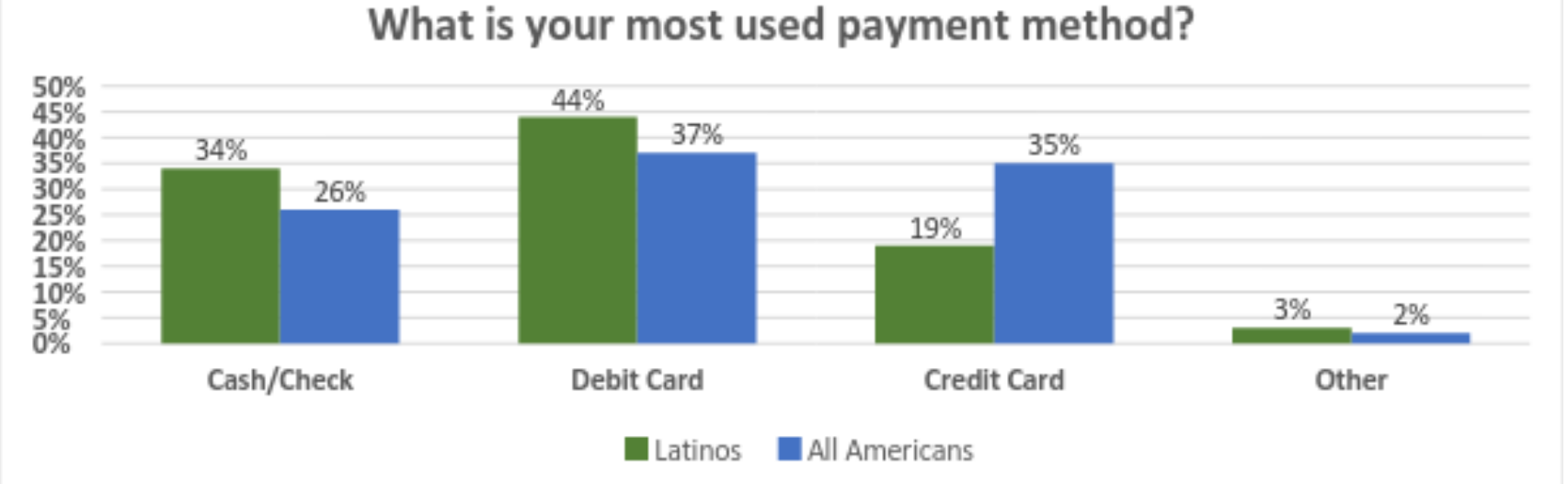

If we look at Latinos as a whole, credit card adoption rates still lag well behind the national average. Just 19% of Latinos used credit cards as their primary payment method for purchases. This compares to 35% of all Americans. Latinos are much more likely to use cash, check or debit cards as the primary means to complete transactions.

Data provided by Nielsen

Data provided by Nielsen

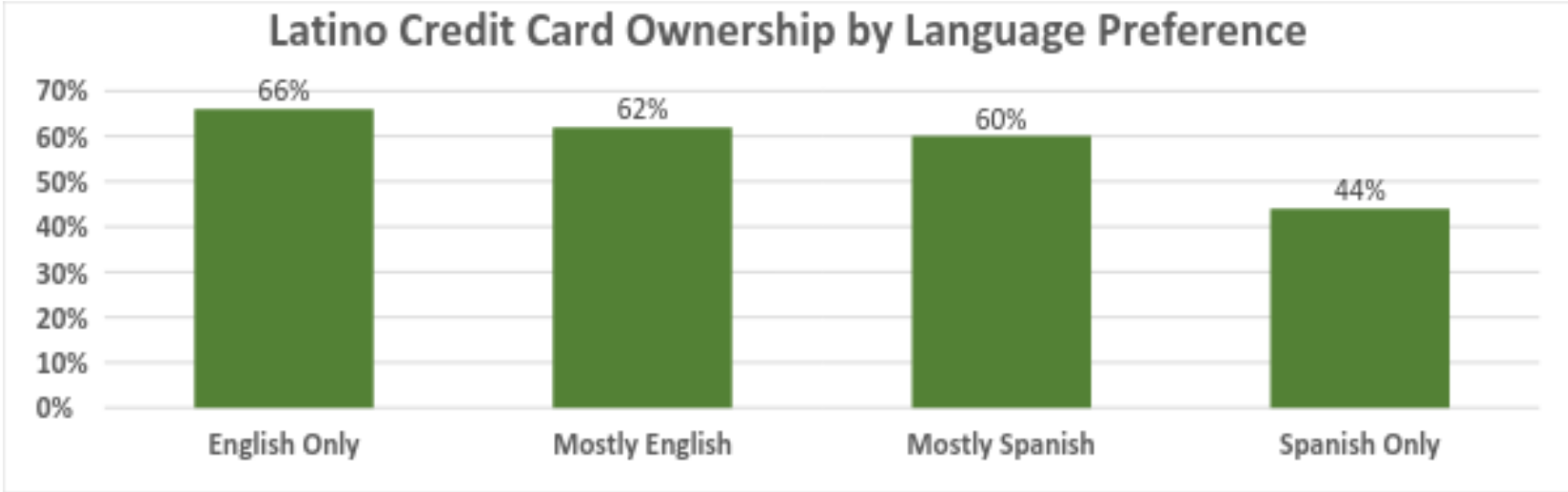

If we drill down a bit deeper, we see that within the Latino community credit card usage varies substantially based on language preference. 66% of English-only speaking Latinos have credit cards compared to just 44% of Spanish-only speaking Latinos. Card usage falls somewhere in the middle for Latinos that speak a mix of English and Spanish.

Data provided by Nielsen

Data provided by Nielsen

On the one hand, this low credit card adoption is a good thing.

In 2016, the average American household held just over $16,000 in credit card debt. In most situations, it will take these families month, or years, to pay down this balance. Credit cards can be a very easy way for families to spend more money than they simply cannot afford to pay back. In this regard, low credit card usage shows that Latinos take their monthly budget seriously and have made prudent financial decisions.

The reverse side of this coin is that many Latinos are missing out on the benefits that credit cards provide. Benefits can include the opportunity to establish credit history, or even re-build a bad credit rating. Having a credit card can greatly simplify bill pay and some cards even provide cash back or travel rewards.

Before we explore the best cards out there, let’s get a firm understanding of the cost of credit cards. This is shown by the Annual Percentage Rate (APR) associated with the card.

APR – The Basics

The best way to think about your card’s APR is the daily cost of holding a card balance. Just divide your APR by 365 to see how much interest is being charged daily on the card’s outstanding balance. For a card with a 16% APR, it would look like this.

16.00% APR / 365 days = 0.0438% daily interest charged

For this example, let’s assume that you received a $2,000 credit card bill at the end of November. Money is tight, so you are only able to pay $1,000 of the $2,000 bill. On December 1st, this APR will start applying to your outstanding balance of $1,000.

Balance on December 1: $1,000 + (0.044% x $1,000) = $1000.44 Balance on December 2: $1,000.044 + (0.044% x $1,000.44) = $1,000.88 Balance on December 3: $1,000.88 + (0.044% x $1,000.88) = $1,001.316

And so on…

You can see from this example how compound interest works. You are not only being charged this APR on your original $1,000 balance… this APR is being applied to the interest on this balance as well. By paying your credit card bill in full each month you will avoid these interest payments. Paying as much of your credit card balance as possible each month is the number one rule of responsible credit card management.

How To Choose a Credit Card and Some of the Best Options

There are a lot of credit cards out there to choose from. A great way to start your search for the right credit card is by asking yourself (or your household) a simple question:

“What am I looking for out of a credit card?”

Is it the card with the lowest fees that can make payments easier? Are you interested in establishing or rebuilding your credit score? How important are travel points, cashback or reward points for you? Are you looking to transfer an existing credit card balance to a card with a lower APR?

How you answer these questions will help determine what card is best for you. We’ve broken down our analysis into these major categories to help you start the process. If you have one specific type of card in mind, jump to the section covering our top picks that will match your needs.

Cards With The Lowest Rates

For most consumers, the most important thing in a credit card is affordability. If you don’t want to pay an annual fee or lofty monthly interest payments, consider these cards for you and your family.

| Card Name | APR | Annual fee |

|---|---|---|

| Capital One VentureOne | 12.49% - 22.49% | $0 |

| Discover it Cashback Match | 11.49% - 23.49% | $0 |

| BankAmericard | 11.49% - 21.49% | $0 |

The interest rates shown are all variable – meaning that the card company has the right to raise (or lower) the APR as they see fit. The majority of credit card APRs are variable, so it is important to read the fine print before signing on the dotted line. We show an APR range in the table above. If you have a high credit score, credit card companies will generally issue you a lower APR. If your credit score is low, you will receive a higher APR. Not sure where your credit score stands? Read our article covering the ins and outs of how credit scores work.

Keep in mind: For some cards, paying your balance 60days late will cause you to receive a penalty APR – which can be as high as 29.99%. Again, reading the fine print and understanding how your APR can fluctuate is critical – even for these low-interest rate cards.

Cards Built for Improving a Credit Score

If you are looking to establish credit history, or repair bad credit, consider these cards.

| Card Name | APR | Credit Range Recommended |

|---|---|---|

| First Progress Platinum Elite | 19.99% | 350 - 629 |

| Capital One Secured MasterCard | 24.99% | 250 – 629 |

| Discover it Secured Card | 23.49% | 250 - 689 |

All three of these cards are secured cards, meaning you will need to put down a deposit with the card company before you can make any purchases. In the event you can’t pay back your balance, the card company will take this deposit in order to recover the funds they are owed. This deposit, and the relatively high APRs associated with these cards, are reflective of the card companies risk in issuing the card to an individual with poor or non-existent credit.

To avoid paying these lofty APRs, simply pay down your credit card balance each month and never carry a balance month-to-month. The credit ranges shown are just estimates and can be used a guideline to see if you will apply. If your credit score is 630 or higher, these credit cards are likely not the best fit.

Cards Designed for Travel

For many families, generating airline mileage points for their expenses can be an attractive benefit to owning a card. The following two cards provide airline miles for every dollar spent. In the case of the Capital One Venture Rewards card, you will receive 40,000 miles when you spend $3,000 during the first three months. Read the fine print on any travel card, as card companies have had a reputation of instituting blackout dates and restrictions covering when these travel points may be used.

| Card Name | Travel Reward | Mileage Bonus | APR |

|---|---|---|---|

| Discover it Miles | 1.5 miles for every $1 | Zero | 11.49% - 23.49% |

| Capital One Venture Rewards | 2 miles for every $1 | 40,000 miles after spending $3,000 within three months | 13.49% - 23.49% |

Another item to consider when choosing a travel rewards card, is which airline your family typically uses when traveling. If you and your family mostly fly Delta, ensure that the card miles you earn are valid through Delta. If you mostly fly United, find a card which has partnered with United.

Cards Designed for Cash Back

The idea behind cash back cards is that you accrue cash as you use your card. These cards typically provide cash back as a percentage of the amount that you spend in a given month. Some cards will even provide double or triple cash back payments for gas or grocery expenses. When looking at cash back cards, it is critical first to understand where most of your credit card purchases go each month. Then, find the cash back card which provides the most bang for your buck on these purchases.

| Card Name | Cash Back Rate | Bonus Offers | Credit Range Recommended |

|---|---|---|---|

| Discover it Cashback Match | 1.00% | Cash back match on first-year purchases | 690 – 850 |

| Blue Cash Preferred | 1.00% | $150 cash back after $1,000 spent in first three months | 690 – 850 |

| Cash Freedom Unlimited | 1.50% | $150 cash back after $500 spent in first three months | 690 – 850 |

Balance Transfers

Balance Transfers are becoming more and more popular. The basic idea with a balance transfer is to take high-interest credit card debt and “store” this debt on a credit card with a lower interest rate. This means lower monthly interest payments as you work to pay down the card balance.

To illustrate this idea, consider the following example.

Let’s say you are currently paying 22% APR on a $10,000 credit card bill. If you make $1,000 monthly payments, you will pay down the balance off in 12 months and end up paying $1,149 in interest. Now, let’s assume you get a new credit card which only has a 17% APR. After the account is opened, you transfer your balance of $10,000 to this new card. If you are still making $1,000 monthly payments, you will end up paying the balance off in just 11 months and paying only $860 on interest. With this move, you have just saved yourself $289 in interest payments and one month of card payments!

In some cases, cards which are designed to be used in balance transfers will allow you to store the balance on the card interest free for 12 or 16 months.

As with any card, it is important to watch out for “introductory rates”. This means that the card will allow you to start with a low-interest rate, but the rate will increase in the future. With balance transfer cards, it is also very important to understand the transfer fees. These are typically between 1% and 3%. You will want to do the math and ensure that you are paying less for the transfer than you are getting in saved interest. Some of these cards will even put limitations on how much of your existing credit card balance can be transferred.

As always, read the fine print before signing the dotted line on a balance transfer credit card.

The Bottom Line

Regardless of which credit card you choose, ensure that the terms of the card match your lifestyle. There isn’t one credit card which is right for everyone. With the information in this article you should have a better idea of which types of cards exist and have a starting point as you begin your search.