Pre-paid cards are one of the fastest growing segments of the card industry in the US. On first look, it seems like they have a lot to offer when compared with other options. However, there are two sides to every story and in the end, pre-paid cards might end up costing you more than what they are worth. Let’s start with the basics first.

What is a pre-paid card?

A pre-paid card is essentially a debit card but instead of being linked to a bank account you have to “load” the card with a certain amount of money before you can use it. As you keep using the card and spend money, the balance on your pre-paid card keeps on reducing. In this respect, a pre-paid card is not much different from a bank linked debit card. What then, is the need to use a pre-paid card? Well, that depends on a couple of factors:

-

Specific types of prepaid cards: Some types of prepaid cards are provided by companies to their employees to pay their salary. Some others are issued by the Government to provide benefits. Then there are ones that you might use for a specific purpose only, like for public transport for example.

-

General purpose reloadable prepaid cards (GPRs or simply, prepaid cards): These types of cards are usually marketed as replacements for credit or debit cards. Though a significant percent of the population has used them at one time or another, they only make sense for people who are outside of the formal banking system. This means people who do not have access to bank accounts or credit unions.

While specific credit cards, like those mentioned above, have their utility, it is the general purpose prepaid debit cards that have become a cause of some concern amongst consumer rights advocates. The reason is that these cards are marketed to the unbanked or underbanked sections of the population, and generally have a lot of unsavoury and hidden costs associated with them. Since you cannot avoid the first category of pre-paid cards (those issued by an employer or the government), we will only look at the general purpose reloadable pre-paid cards here.

Why you should avoid pre-paid general purpose cards.

Pre-paid cards have been the subject of much criticism and consumer activism. The reason for this is not only the higher and hidden costs associated with them, but also a flurry of frauds and misdirected marketing efforts.

High costs and mountains of fees

This is the biggest reason to avoid a pre-paid card. Know that the main reason general purpose pre-paid cards exist is because they are marketed to people who are outside of the formal banking system. This usually means that pre-paid card companies think that their customers do not have access to any other viable option other than a pre-paid card. Because of this reason, pre-paid card companies charge a lot of fees which would not be acceptable in any other form of debit or credit card or bank account. Here are just some of them:

-

Card activation fee – A onetime activation fee which can go up to $10.

-

Monthly maintenance fee – A recurring monthly fee which can also go up to $10 for some cards.

-

ATM withdrawal fee (at the issuer’s ATM) - This is normally nil but some companies charge up to $2.25 even here.

-

Non- issuer’s ATM withdrawal fee – This is almost always between $2 and $2.5 per transaction. What’s worse is that this does not include a further bank fee which is applied additionally.

In addition to these common charges, there are other costs involved. These may be closing charges – which apply when you want to close the account, charges for requesting a paper statement, charges for making a balance inquiry, declined transaction fee, inactivity charges and so on.

Also, many companies will offer to waive the monthly maintenance fee, but in return they require either a minimum balance to be maintained, or that the pre-paid card be linked to your checking account or salary account.

Another major concern which has been identified by consumer protection advocates is that there is a lot of differentiation in the fee structure and nomenclature of various charges by pre-paid card companies. This makes it a bit difficult to ascertain which card would actually be cheapest for you.

Pre-paid cards do not build or improve your credit history

A common reason for people to get a pre-paid card is if they are rejected for a credit card. Consumers buy a pre-paid card with the misconception that it will help build their credit score. This is not true.

You credit history is just that – a history of all your transactions where you borrow money. The credit report will incorporate things such as auto loans, home loans, credit cards and other borrowings but do not contain details about any product where you have not borrowed money. The credit report exists only so that lenders can check your repayment history of loans from other banks. Given this function, any details related to pre-paid cards are not generally recorded (unless you get into an overdraft which goes unpaid).

Once again, to conclude, pre-paid cards will not help you build or improve your credit history and will not help you secure a credit card or any other type of loan.

Higher susceptibility to scams or fraud

Pre-paid cards are a prime target for fraudsters or criminals. This is primarily because of two reasons:

-

Pre-paid cards are normally used by consumers who are outside the formal banking system and are thus more vulnerable. Secondly, some pre-paid cards do not offer fraud protection facilities which are available to normal credit/ debit cards.

-

Another reason why prepaid cards may be more susceptible to fraud is that certain one-time usage cards do not require any Know Your Customer (KYC) documentation. KYC is a mandatory requirement where banks have to collect the identity proofs of their customers in order to prevent money laundering and other such financial crimes. Cards which do not require KYC, are easier to use for illegal activities and therefore these cards are targeted a lot more frequently than other types of cards or bank accounts.

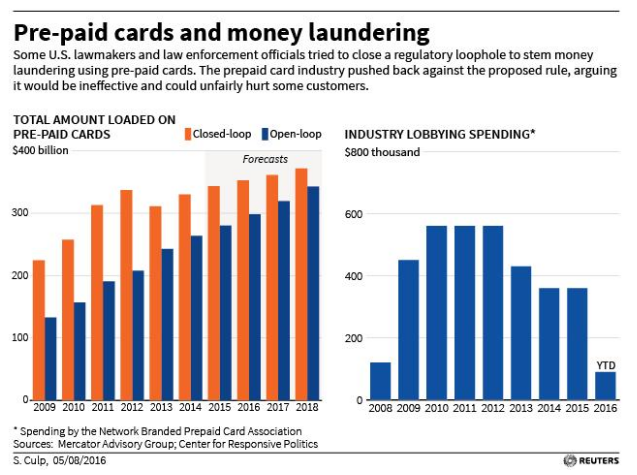

Recent attempts at regulations aiming to curtail the use of pre-paid cards for money laundering proved to be unsuccessful. Image Source: Reuters

Lesser regulatory oversight

Prepaid cards do not have the same kind of federal regulatory protection and oversight that normal bank debit cards do. Although most of the prepaid debit cards now have Federal Deposit Insurance protection (you should double check on this and reject any that doesn’t), they are still not as thoroughly covered as some of the alternatives.

But what about the benefits of prepaid cards?

Whether or not you really need a reloadable general purpose pre-paid card depends on your exact circumstances. However, in most cases there are better alternatives available – cheaper and safer alternatives. Let’s have a look at some of the most common reasons why people opt for pre-paid cards:

Not being able to get a credit card due to a short or poor credit history – This is the most common reason for getting a prepaid card. However, there are other options available if you have a bad credit history - like getting a debit card which is linked to your bank account. The advantage of getting a normal debit card is that you will save quite a bit on transaction costs and other fees. An online bank account is also a great option as these generally have the lowest cost structure.

To maintain financial discipline – Some people opt for prepaid debit cards because they have had a bad experience of going into debt with a credit card and have been burnt by the very high penalty rates. This is a valid reason but again, getting a normal account would be cheaper transnationally. Moreover, the right way to tackle a spending problem is through self-discipline rather than anything else!

Being able to shop online – Again, you are better off with the options mentioned above. Also, there are gift cards available which apply to a particular store or chain and can be used as viable alternatives.

Pre-paid cards are safer than carrying around cash – This is generally true. However, pre-paid cards are usually less secure than debit or credit cards. They might or might not have the fraud protection features offered by the regular card companies and are generally more susceptible to online fraud.

To build or improve your credit history – This is simply not true. Debit cards cannot do this for you and if you need something to improve your credit score, you might be better off with a secured credit card or getting any other type of collateral backed loan. As you maintain your loan account in good standing, your credit will improve. For more information, refer to our article on improving your credit.

What are my options then?

The best alternatives to pre-paid cards are obviously credit cards or debit cards linked to bank accounts. However, if you are unable to use one of these for any reason (especially if you have a bad credit score), you still have a few better alternatives than pre-paid cards.

Secured Credit Cards – Secured cards barely qualify as credit cards. They are usually issued against some form of collateral, like a cash deposit, and generally have low limits. However, the advantage of these secured credit cards is that if you use them properly – meaning you make timely repayments and do not spend too much of your credit limit – over time your credit score will improve.

Credit Unions/ Online Banks – These options are almost always better than most pre-paid credit cards. The main difference is in maintenance and transaction costs which are higher and more frequent for most pre-paid debit cards. We say most because there are always exceptions. However, generally speaking, unless you go into costly overdrafts, using an online bank will always be cheaper. Besides, you don’t need a credit history to open a checking or savings account. Finally, it should be mentioned that credit unions are generally more consumer friendly than banks and you stand a better chance of securing a loan there.

In conclusion

The primary disadvantage of prepaid cards is higher transaction costs and a slightly higher risk of fraud or theft. Furthermore, most of the advantages of such cards can be more cheaply gained with other viable alternatives.

If you still have to go for a prepaid card, stick to the ones offered by reputable companies like American Express. It might also be a good idea to ask for and thoroughly check a comprehensive list of all fees and charges.